The Complete Guide to Commercial Real Estate Certifications

Comparing CREXOM™, RPA®, CPM®, and CCIM® — and Choosing the Right Path for Your CRE Career

Updated: November 2025

Introduction

Commercial real estate is a multidisciplinary field that blends operations, finance, asset strategy, tenant management, building systems, and investment decision-making. Because CRE roles do not follow a single, linear pathway, certifications have become an important way for professionals to build credibility, validate knowledge, and establish competency in specialized areas of practice.

This guide is designed for:

- Early-career professionals entering the industry

- Property managers, analysts, and asset management staff

- Operations and facilities professionals expanding their skill sets

- Career changers seeking formal CRE training

- Individuals and training organizations seeking to understand how industry certifications align with professional practice

- Organizations evaluating the best training paths for their teams

In this guide, we explore four major certifications that represent distinct segments of the CRE profession:

- CREXOM™ – a modern operations, building-level execution, and applied readiness certification

- RPA® (Real Property Administrator) – a deep dive into property management administration

- CPM® (Certified Property Manager) – a leadership-level property and asset management credential

- CCIM® (Certified Commercial Investment Member) – an investment, capital markets, and deal analysis designation

The purpose of this document is to provide a neutral, comprehensive, and professionally grounded overview of how each certification fits into today’s commercial real estate landscape.

Readers will learn:

- What each certification teaches

- The competencies and professional standards each was built around

- Career paths each certification supports

- Strengths and limitations within real-world application

- How modern operational training fits into a landscape historically anchored in management and investment credentials

- How to evaluate which certification aligns with your individual goals

The Commercial Real Estate Certification Landscape

Commercial real estate offers a wide range of professional pathways, and no single credential covers the entire industry. Instead, certifications have evolved into distinct categories that reflect the varied competencies required across investment, management, technical operations, and modern execution-oriented roles.

This section provides a structured overview of the primary certification categories in the field. It offers a neutral map of how the industry organizes professional development—and where programs like CREXOM™, RPA®, CPM®, and CCIM® belong within that structure.

1. Investment & Capital Markets Certifications

Focus Area:

Financial modeling, market analysis, underwriting, deal structuring, and portfolio strategy.

Typical Designations:

- CCIM®

- Argus modeling certificates

- Real estate finance certificates and modeling credentials (varies by provider)

Who They Serve:

Professionals whose roles center on evaluating, acquiring, disposing, or analyzing commercial real estate assets.

Purpose in the Ecosystem:

These certifications validate an individual’s capability in understanding capital flows, return metrics, valuations, and investment risk—key components for acquisitions teams, private equity firms, lenders, and financial analysts.

2. Property & Asset Management Certifications

Focus Area:

Property operations, tenant relations, budgeting, lease administration, and long-term asset planning.

Typical Designations:

- CPM®

- RPA®

Who They Serve:

Individuals responsible for property or portfolio performance, including building oversight, budgeting, reporting, and management strategy.

Purpose in the Ecosystem:

These certifications ensure professionals understand the management cycle, owner objectives, and the administrative and financial components of keeping buildings performing over time.

3. Technical & Facilities Certifications

Focus Area:

Building systems, engineering fundamentals, maintenance planning, energy management, and operations safety.

Typical Designations:

- SMA® (Systems Maintenance Administrator)

- SMT® (Systems Maintenance Technician)

- FMP® (Facilities Management Professional)

- LEED® credentials

Who They Serve:

Facilities teams, building engineers, and professionals who need technical knowledge of mechanical systems, energy usage, sustainability, and physical building operations.

Purpose in the Ecosystem:

These programs emphasize the physical and technical functions of buildings—skills required to maintain infrastructure reliability, reduce operating expenses, and ensure regulatory compliance.

4. Modern Operations & Applied Readiness Certifications

(A newer and increasingly important category)

Focus Area:

Cross-functional operational capability, building-level execution, tenant coordination, applied financial operations, lease intelligence, and asset-level performance fundamentals.

Primary Example:

- CREXOM™ — Commercial Real Estate Execution, Operations & Management

Who They Serve:

Professionals who benefit from applied, building-level readiness for modern CRE roles that require integrated knowledge across:

- Property management and building operations

- Facilities oversight and service coordination

- Building systems proficiency and operational coordination

- Tenant and vendor interactions

- Operational finance and budget execution

- On-site execution and field-level decision making

- Lease abstracting, analysis, and interpretation

- Asset valuation fundamentals (NOI impact, risk drivers, cost recovery, CapEx effects)

- Risk mitigation and operational problem solving

- Early-career operational readiness

Purpose in the Ecosystem:

This category reflects an emerging emphasis on applied, building-level readiness and cross-functional operational capability.

Deep-Dive Reviews of Major Commercial Real Estate Certifications

Commercial real estate certifications occupy different roles across the professional ecosystem. Each is designed to build competency within a specific area of practice—operations, management, leadership, or investment. The following sections provide a detailed, side-by-side overview of the four designations examined in this guide.

1. CREXOM™ — Commercial Real Estate Execution, Operations & Management

What it Teaches:

CREXOM™ focuses on real-world operational execution and the competencies required for early-career readiness inside commercial buildings and portfolios. The curriculum spans:

- Property operations

- Facilities coordination

- Building systems proficiency (MEP, life safety, operational coordination)

- Service contracts and vendor oversight

- Tenant and stakeholder communication

- Operational finance and budget execution

- Expense categories and cost recovery mechanics

- Lease abstracting, analysis, and interpretation

- Asset valuation fundamentals and NOI impact

- Capitalization rates, valuation methods, and asset-level risk assessment (applied at the operational and building-performance level)

- Field-level decision making and risk mitigation

- On-site operations and coordination workflows

The program emphasizes applied capability, ensuring candidates understand not just the theory of CRE operations, but how tasks are executed in practice.

Who It Is Ideal For:

- Early- to mid-career professionals entering property or operations roles

- Individuals transitioning from related fields (construction, hospitality, admin support, facilities)

- Property management coordinators/assistants

- Junior asset management or analyst roles needing operational grounding

- Individuals seeking practical, early- to mid-career CRE exposure

- Organizations wanting standardized, operational training for new team members

Strengths:

- Provides applied operational readiness uncommon in legacy programs

- Bridges credential-based knowledge and building-level execution

- Covers practical financial concepts tied to asset performance

- Strong alignment with real job responsibilities encountered early in CRE careers

- Complements higher-level designations like CCIM®

Limitations:

- Not designed as a leadership or portfolio management credential

- Does not replace advanced investment analysis certifications

- Focuses primarily on operations rather than strategic ownership-level responsibilities

Career Paths Supported

- Property Administrator / Coordinator

- Assistant Property Manager

- Property Manager

- Operations Manager

- Facilities Coordinator

- Building Management roles

- Analyst roles requiring operational grounding

- Tenant experience and service operations roles

2. RPA® — Real Property Administrator (BOMA®)

What it Teaches:

The RPA® designation focuses on property administration, emphasizing the financial and managerial responsibilities of operating commercial buildings. Core topics include:

- Property operations and maintenance

- Budgeting and financial reporting

- Lease administration

- Risk management fundamentals

- Property accounting principles

- Tenant relations and service standards

- Building operations and oversight at an administrative level

The curriculum is traditionally aligned with the responsibilities of property management teams in multi-tenant office and commercial environments.

Who It Is Ideal For:

- Property administrators

- Assistant property managers

- Early- to mid-career professionals in property management

- Individuals seeking deeper exposure to property-level financials and administration

- Those pursuing a traditional property management career track

Strengths:

- Recognized and respected in property management roles

- Strong grounding in the administrative and financial functions of building management

- Well-established coursework and industry reputation

- Provides structured knowledge for advancing into full property manager roles

Limitations:

- Limited focus on applied, on-site operational tasks

- Less emphasis on building systems proficiency

- Does not cover investment analysis or asset-level strategy

- Primarily focused on office and traditional commercial assets

Career Paths Supported

- Property Administrator

- Assistant Property Manager

- Property Manager

- Building Operations Support roles

- Administrative roles within owner/manager organizations

3. CPM® — Certified Property Manager (IREM®)

What it Teaches:

The CPM® designation offers a broad, leadership-oriented education in property and asset management. Key focus areas include:

- Property and portfolio management

- Financial analysis and asset planning

- Capital expenditure planning

- Revenue optimization and expense control

- Ethics, leadership, and team management

- Risk management and compliance

- Long-term asset performance strategy

The CPM® emphasizes strategic and managerial decision-making, preparing professionals for leadership roles overseeing assets or portfolios.

Who It Is Ideal For:

- Property managers with experience

- Portfolio managers

- Asset management professionals

- Individuals targeting leadership or senior-level responsibility

- Professionals moving beyond administrative work into strategic oversight

Strengths:

- Well-recognized across ownership and management organizations

- Strong emphasis on leadership and financial strategy

- Positions candidates for advancement to senior roles

- Covers portfolio-wide asset and revenue planning

Limitations:

- Not designed for beginners or on-the-ground operational tasks

- Limited focus on technical building systems or early-career execution

- Does not address detailed investment modeling at the CCIM level

Career Paths Supported

- Property Manager (mid- to senior-level)

- Senior Property Manager

- Portfolio Manager

- Asset Manager

- Director of Property Management roles

4. CCIM® — Certified Commercial Investment Member (CCIM Institute)

What it Teaches:

The CCIM® designation is centered on investment analysis, capital markets, and advanced financial decision-making. The curriculum focuses on:

- Financial modeling and discounted cash flow analysis

- Investment return metrics

- Market and demographic analysis

- Deal structuring and negotiation

- Portfolio theory

- Capitalization rates, valuation methods, and risk assessment

- Investment strategy for acquisitions and dispositions

This certification is widely regarded as the standard for advanced real estate investment competency.

Who It Is Ideal For:

- Investment analysts

- Acquisitions professionals

- Commercial brokers specializing in investment deals

- Asset managers with investment responsibility

- Developers and capital markets professionals

Strengths:

- Highly recognized within investment and brokerage sectors

- Deep coverage of financial modeling and deal analysis

- Strong network and industry community

- Valuable for individuals making or advising on investment decisions

Limitations:

- Not designed for property-level operations or early-career on-site roles

- Limited focus on building systems or facilities operations

- Requires significant time and financial commitment

- Best suited for mid-career professionals with foundational CRE knowledge

Career Paths Supported

- Investment Analyst

- Acquisitions Associate / Manager

- Capital Markets roles

- Commercial Broker

- Developer / Development Analyst

- Asset Manager (investment-oriented)

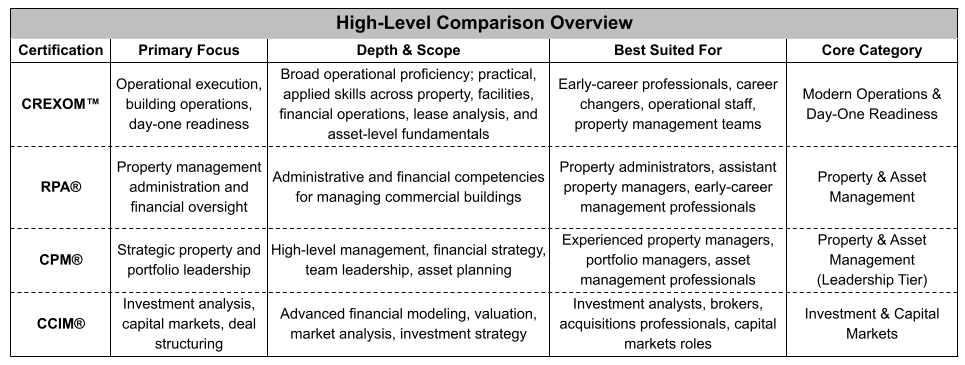

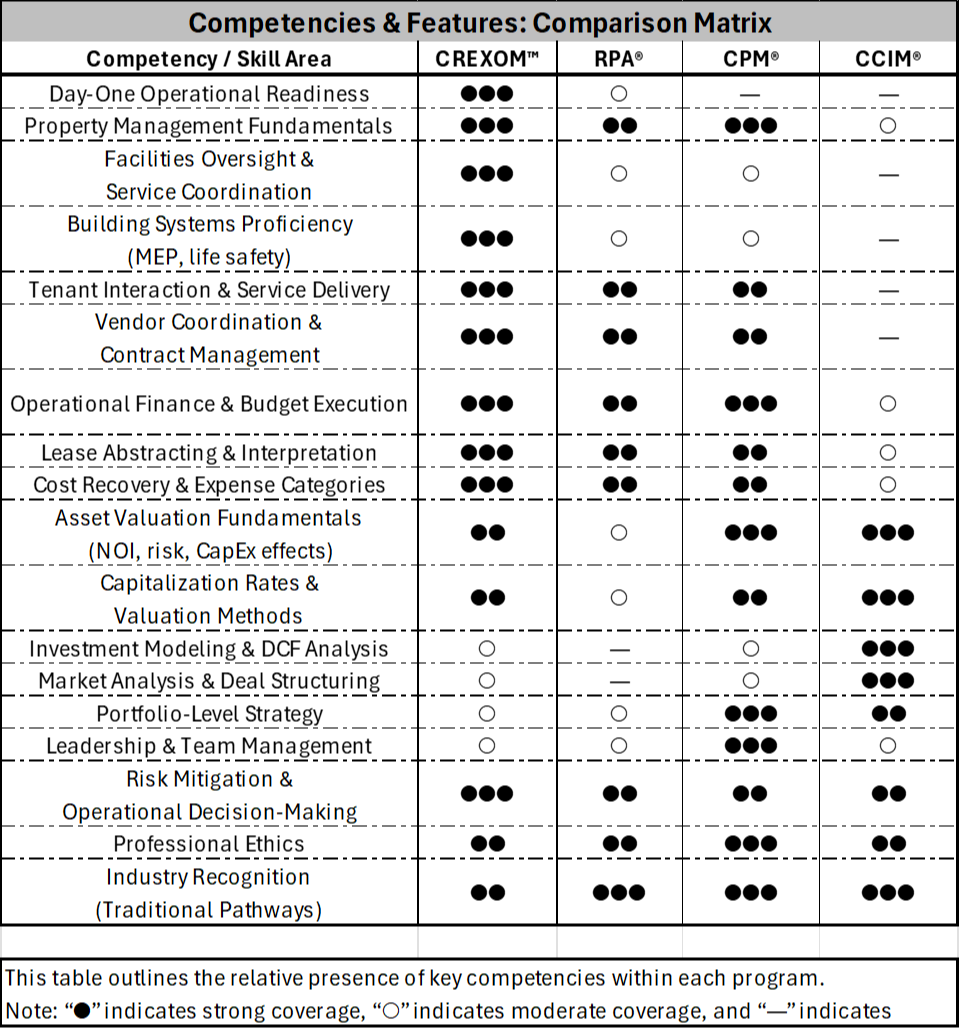

Comparison Tables

The following tables provide a structured, at-a-glance comparison of the four certifications discussed in this guide. They summarize focus areas, competencies, and career alignment to help readers understand how each designation fits within the commercial real estate ecosystem.

Each certification addresses a distinct segment of the commercial real estate profession. CREXOM™ emphasizes operational execution and building-level capability. RPA® reinforces administrative and property financial competencies. CPM® provides leadership and asset-planning depth. CCIM® delivers advanced investment and valuation analysis. Together, these programs represent the major credential categories within the modern CRE landscape.

Where CREXOM™ Fits in the Commercial Real Estate Certification Ecosystem

The commercial real estate certification landscape has historically been organized around three primary domains: property and asset management, technical and facilities operations, and investment and capital markets. Each domain reflects established professional pathways within the industry, and the certifications associated with them.

The emergence of modern operations and applied readiness certifications, represented by programs such as CREXOM™, reflects a shift in how commercial real estate organizations operate today. Leaner teams, technology-enabled portfolios, and heightened tenant, ownership, and regulatory expectations have increased the demand for professionals who can contribute meaningfully to day-to-day operations earlier in their careers.

A Complementary Category, Not a Competitive One

CREXOM™ occupies a category distinct from legacy designations. Its emphasis is on:

- Applied operational capability

- Building systems literacy

- Operational finance and cost awareness

- On-site coordination and vendor oversight

- Lease interpretation and practical administration

- Tenant relations and service execution

- Asset-level risk awareness and decision support

Where traditional certifications emphasize broader career progression, portfolio-level strategy, or advanced financial analysis, CREXOM™ focuses on operational execution inside buildings and across property teams—the environment where most commercial real estate careers begin.

Rather than replacing legacy programs, CREXOM™ complements them by preparing early- to mid-career professionals and career changers with the foundational skills required before advancing into higher-level management, leadership, or investment roles.

Bridging Legacy Certifications and Modern Operational Reality

Legacy commercial real estate certifications have traditionally emphasized:

- Financial analysis and reporting

- Portfolio-level strategy and planning

- Property management administration

- Investment and market evaluation

- Leadership and governance frameworks

These competencies are essential. However, many established designations place comparatively less emphasis on the day-to-day operational mechanics that directly influence building performance, tenant experience, and asset-level outcomes—particularly at the on-site and early-career execution level.

CREXOM™ reinforces applied operational capability through instruction grounded in:

- Building-level execution and coordination

- Lease interpretation and operational implications

- Expense control, cost recovery, and budget execution

- Vendor management and service delivery workflows

- Building systems literacy and operational risk awareness

- Field-level decision-making inside active assets

Rather than duplicating the focus of legacy credentials, CREXOM™ fills a structural gap in the certification landscape by formalizing the operational competencies required to perform effectively inside commercial buildings—capabilities that support, precede, and strengthen progression into administrative (RPA®), leadership (CPM®), or investment-focused (CCIM®) designations.

Strengthening the Overall Professional Pathway

Each major commercial real estate certification supports a distinct segment of professional development:

- CREXOM™ → Operational readiness and applied, building-level competence

- RPA® → Property management administration and financial oversight

- CPM® → Strategic leadership and portfolio management

- CCIM® → Investment, valuation, and market-level financial analysis

Operational proficiency is not an early-career phase; it is a core competency across the entire commercial real estate lifecycle. CREXOM™ formalizes these capabilities, offering structured development in building systems literacy, tenant coordination, service delivery, operational accounting, lease interpretation, and day-to-day financial execution.

These competencies remain relevant whether a professional later pursues administrative pathways (RPA®), leadership pathways (CPM®), or investment pathways (CCIM®).

Each certification serves a distinct functional purpose. CREXOM™ establishes applied operational and execution-based capability; RPA® deepens administrative and financial oversight; CPM® expands into strategic management and portfolio leadership; and CCIM® advances expertise in investment, valuation, and capital markets. These credentials sit alongside one another within the commercial real estate ecosystem, rather than existing in a linear hierarchy.

Which Certification Is Right for You?

Selecting a commercial real estate certification depends on your current role, professional experience, and long-term objectives. Each designation supports a distinct segment of the industry and develops competencies aligned with different responsibilities and career pathways. The following guidance summarizes which programs align most closely with common CRE functions and professional goals.

1. If your role centers on building operations, on-site coordination, or day-to-day execution

Best fit: CREXOM™

Professionals who work directly with building systems, tenant coordination, vendor oversight, facilities support, or operational finance typically benefit most from a program that builds applied, building-level capability. CREXOM™ is designed for early- and mid-career professionals who must contribute meaningfully to operations and who need structured development in operational accounting, service delivery, lease interpretation, and risk-aware decision-making.

2. If you support administrative, financial, or tenant-facing property management functions

Best fit: RPA®

The RPA® designation aligns with property administrators, assistant property managers, and individuals beginning to oversee budgets, financial reporting, tenant service programs, and core administrative processes within commercial buildings. It supports the foundational skills necessary for advancing into formal property management roles.

3. If your responsibilities include portfolio planning, strategic management, or oversight of multiple assets

Best fit: CPM®

Professionals moving toward property or asset management leadership positions often select the CPM® designation. It develops broader management competencies, including financial strategy, team leadership, investment planning at the property level, and oversight of multi-asset portfolios. CPM® is well suited for mid-career professionals progressing into senior management tracks.

4. If your work focuses on investment analysis, valuation, or capital markets

Best fit: CCIM®

Roles in acquisitions, investment sales, brokerage, financial modeling, underwriting, or capital markets rely heavily on analytical and valuation expertise. The CCIM® designation provides advanced instruction in financial modeling, discounted cash flow analysis, market assessment, and investment strategy, making it the most appropriate credential for professionals pursuing investment-oriented career paths.

5. If you are transitioning into commercial real estate from another field

Best fit: CREXOM™ or RPA® depending on the desired entry point

Career changers who expect to work in property operations, tenant coordination, facilities support, or operational finance typically benefit from CREXOM™'s applied structure and focus on early-role proficiency. Those entering roles aligned with administrative functions or early property management may find RPA® appropriate as an initial step.

6. If you intend to pursue multiple certifications over time

Best fit: CREXOM™ (operational base) + CPM® or CCIM® (specialized path)

Professionals who expect to build a multi-disciplinary career—common in CRE—often pair an operational certification with a later-stage designation. CREXOM™ supports a broad operational literacy that remains relevant across management, leadership, and investment roles, while CPM® and CCIM® provide specialization in their respective tracks.

7. If your goal is to strengthen practical, immediately applicable CRE capability

Best fit: CREXOM™

CRE operations require proficiency in functions many professionals must handle from the outset: reading lease provisions, coordinating building systems, interpreting budgets, addressing tenant concerns, evaluating costs, and making operational decisions that influence asset performance. CREXOM™ is structured to meet this need directly.

Summary

Choosing the appropriate certification depends on the nature of your work and the direction you want your career to progress. CREXOM™, RPA®, CPM®, and CCIM® each support different—but equally important—competency areas within the commercial real estate industry. Matching the certification to your functional role ensures that your learning aligns with both your current responsibilities and long-term professional goals.

Certification Comparisons (Explore the Series)

CREXOM™ vs. RPA® — Operational vs. Administrative Pathways

CREXOM™ vs. CPM® — Operational Management vs. Strategic Leadership

CREXOM™ vs. CCIM® — Operations vs. Investment Specialization

Conclusion

Commercial real estate is a broad and multifaceted profession, requiring competencies that span operations, management, finance, building systems, tenant relations, and investment analysis. The certifications examined in this guide—CREXOM™, RPA®, CPM®, and CCIM®—each represent a different segment of this landscape and support professionals at various stages of their careers.

CREXOM™ formalizes the operational, execution-oriented, and building-level capabilities required across early- and mid-career roles.

RPA® strengthens administrative and financial oversight within property management functions.

CPM® develops strategic leadership and portfolio-level management competencies.

CCIM® advances expertise in valuation, investment analysis, and capital markets.

These certifications do not exist in competition with one another. Instead, they operate in parallel, each contributing to the broader professional ecosystem. The right choice depends on the nature of a professional’s current responsibilities, long-term career goals, and the specific competencies they aim to develop.

As the commercial real estate industry continues to evolve—driven by technology, changing tenant expectations, and increasingly complex assets—the need for clearly defined, role-aligned professional development pathways remains essential. Whether focused on operational readiness, property administration, strategic management, or investment analysis, each certification provides a structured means of building the knowledge and skills needed to contribute effectively within the modern CRE environment.

Start Building Practical Capability for Today’s Commercial Real Estate Roles

Build the capabilities that commercial real estate roles now demand—and advance your career with structured, practical, and industry-aligned training.