CREXOM™ vs. CCIM® — A Professional Comparison

A structured, objective comparison of two distinct commercial real estate pathways—operations vs. investment.

Updated: November 2025

Introduction

Commercial real estate includes both operational and investment-oriented professional tracks. Two credentials that support these distinct pathways are CREXOM™, focused on operational capability and building execution, and CCIM®, focused on investment analysis, valuation, and capital markets.

Professionals often compare these certifications when deciding whether to deepen operational expertise or pursue an investment-focused specialization.

This guide provides a neutral, structured comparison of CREXOM™ and CCIM®.

What CREXOM™ Covers

CREXOM™ includes the applied financial and valuation literacy necessary to support asset performance and inform investment decisions at the building level. This includes:

-

Operational-level valuation principles (NOI, cap rates, risk drivers)

-

Building-level financial analysis and performance interpretation

-

Repositioning scenarios, operational impact, and readiness planning

-

Operational considerations in dispositions and asset transitions

-

Understanding how operational decisions influence asset value

-

Capital planning, budgeting, and long-range operational implications

This places CREXOM™ firmly within applied financial and valuation concepts relevant to building-level operations and asset performance, while providing a practical understanding of investment fundamentals without requiring advanced modeling, DCF structures, or capital markets strategy.

What CCIM® Covers

The CCIM® designation focuses on investment analysis, financial modeling, and capital markets. It is a specialist program for professionals engaged in valuation, transactions, and investment-driven decision-making.

Core topics include:

- Discounted cash flow (DCF) analysis

- Market and submarket evaluation

- Acquisition strategies and investment decision-making

- Investment modeling, underwriting, and return metrics

- Capital structure, risk, and financial performance

- Dispositions, repositioning, and portfolio impact

CCIM® is widely recognized for analysts, brokers, acquisitions professionals, and capital markets specialists.

Who Each Certification Serves

CREXOM™

Ideal for:

- Operations professionals

- Property managers and building-level coordinators

- Facilities and tenant-facing roles

- Career changers entering CRE through operations

- Early- and mid-career professionals building execution capability

- Individuals preparing for future management roles through operational grounding

CCIM®

Ideal for:

- Investment analysts and underwriters

- Commercial brokers and transaction professionals

- Acquisitions and asset management professionals

- Individuals focused on modeling, valuation, or capital markets

- Mid-level professionals specializing in investment decision-making

Strengths & Limitations

CREXOM™ — Strengths

- Strong applied operational and building management focus

- Immediate, practical utility inside real buildings

- Emphasizes execution, coordination, and service delivery

- Accessible to early-career and transitioning professionals

- Builds essential operational literacy that supports asset performance

CREXOM™ — Limitations

- Not designed for advanced investment modeling, underwriting, or DCF analysis

- Does not cover capital markets structure, deal sourcing, or transactional strategy

CCIM® — Strengths

- Deep investment and financial analysis curriculum

- Highly respected in acquisitions, brokerage, and capital markets roles

- Strong focus on valuation, modeling, and underwriting

- Emphasizes return metrics, deal structure, and investment performance

CCIM® — Limitations

- Not applicable to daily building operations or service delivery

- Limited coverage of facilities, systems, or operational execution

- Not suitable for early-career professionals without financial experience

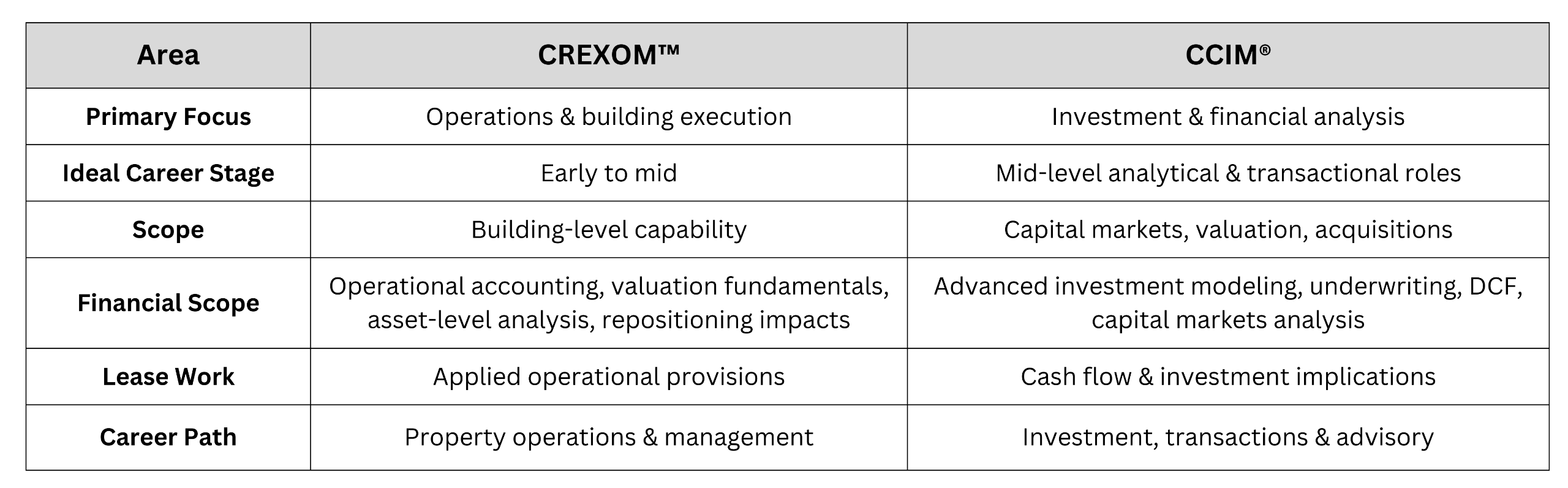

Key Differences at a Glance

Which Certification Should You Choose?

Choose CREXOM™ if you:

- Work in building operations, property management, or tenant coordination

- Need applied financial and lease execution capability

- Support day-to-day building performance

- Prefer operational roles with future management potential

- Are entering CRE without investment or modeling experience

Choose CCIM® if you:

- Focus on investment analysis or underwriting

- Work in brokerage, acquisitions, or capital markets

- Need skills in valuation, modeling, and DCF analysis

- Pursue transaction-heavy or advisory roles

- Aim to specialize in investment decision-making

Conclusion

CREXOM™ and CCIM® serve two distinct but equally important areas of commercial real estate.

CREXOM™ emphasizes operational capability, service delivery, and building-level execution.

CCIM® develops advanced investment, modeling, and financial analysis expertise.

The right credential depends on whether your career path leans toward operations or investment.

Advance Your CRE Career With Applied Operational Capability

Build the operational capability essential to CRE—and establish a strong foundation for future leadership before advancing into investment-focused roles.